| |

Rising AI Spending Exposes Limits in Chip Supply Chains How Markets are Reacting February 06, 2026 |

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored ContentTrading the Oil Supply Shock Oil markets are adjusting. Venezuela's disruption is removing key barrels from the system at a time when spare capacity is already limited. We have put together a concise trading briefing, "Top 3 Energy Stocks Emerging From Venezuela's Disruption," to help you prepare. - Supply Pressure: What the charts show before headlines catch up.

- Watchlist: Three energy stocks traders are watching closely.

- Strategy: Preparation, not just prediction.

Click Here to Request the Free Report » By following the link above, you're choosing to opt in to receive insightful updates from Investing Ideas Daily + 2 free bonus subscriptions! Your privacy is important to us. You can unsubscribe anytime. See our privacy policy for details. (Privacy Policy) |

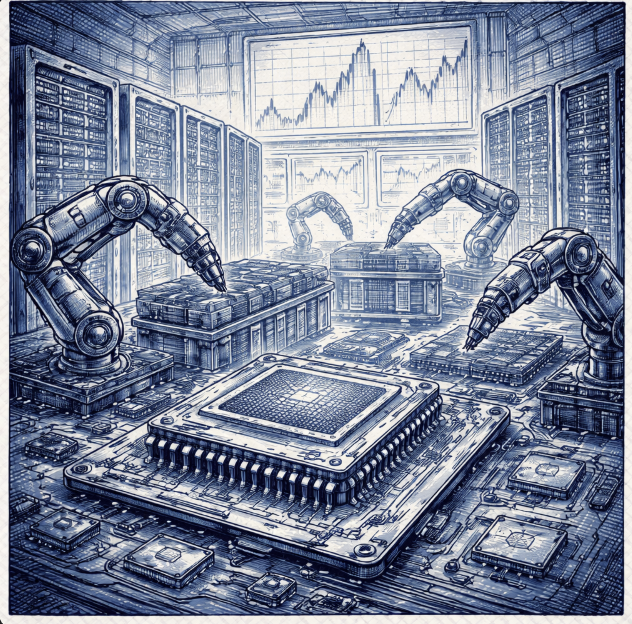

Where AI demand meets hardware limits Where AI demand meets hardware limits

Good Morning, New signs of strain are showing up beneath the surface of the AI boom. Reports that major chipmakers are warning of months long server delays in China point to real supply limits as data-center spending accelerates. We break down what's driving the bottlenecks, why it matters for tech stocks, and how hardware constraints could start to shape the next phase of the rally. If you're indexed to the S&P or heavy in AI winners, this is the one to read.

OpenAI's GPT-5.3-Codex launch raises cybersecurity alarms, SBA loan cuts for green card holders threaten $12B in small business capital, and Starbucks faces loyalty program backlash amid falling revenue.

Don't forget to voice your opinion in my polls below.

Here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapYesterday's trading session was a bloodbath, with the S&P 500 and Nasdaq marking their third consecutive day of declines. The Dow shed nearly 600 points, driven by a tech sector rout and broader risk-off sentiment. Bitcoin's slump below $70,000 added fuel to the fire for crypto-linked stocks. Here's what moved the needle.

- Tech Selloff Accelerates: Nasdaq dropped 1.6% as AI software fears and Qualcomm's weak Q2 guidance dragged down chipmakers and software stocks. → Reuters

- Amazon Disappoints Post-Earnings: Shares fell 9% after-hours despite cloud growth, as profit guidance missed and capex plans spooked investors. → CNBC

- Bitcoin Bleeds Out: Crypto markets stumbled with Bitcoin nearing $72,000, pulling down Coinbase and MicroStrategy by over 6%. → StockTwits

|

📉 Daily Performance Snapshot| Index/Asset | Closing Value | Change |

|---|

| S&P 500 | 6,810.36 | -72.36 (-1.05%) | | Nasdaq | 22,540.59 | -363.99 (-1.59%) | | Dow Jones | 48,908.72 | -592.58 (-1.20%) | | Gold | 4,887.80 | +107.24 (+2.24%) | | Crude Oil | 63.14 | -0.15 (-0.24%) | | Bitcoin | 66,471.00 | -3,928.00 (-5.58%) | | 10-yr Treasury Yield | 4.29% | +0.01 (+0.23%) |

|

🔭 What to Watch TodayToday's calendar isn't packed, but the events on deck could sway markets. Earnings from big names and a key sentiment report are in focus, alongside geopolitical developments that might rattle nerves. Earnings: Toyota, Philip Morris, Biogen: Toyota's report comes amid a leadership shakeup and a 43% profit drop—expect volatility. Philip Morris and Biogen also report, with potential sector impacts. → The StreetMichigan Consumer Sentiment (10 AM ET): This preliminary report could signal whether consumer confidence is cracking under market and labor data pressures. → ABC NewsMiddle East Tensions: With U.S. military buildup near Iran confirmed by satellite imagery, any escalation could spike oil prices or risk assets. → Finance Monthly |

💡 Opportunity WatchAmid the market gloom, a few themes stand out for savvy investors. Whether it's a beaten-down sector with recovery potential or a consumer trend gaining steam, here's where I'm looking for upside. - Maxeon Solar (MAXN): Shares spiked 19% pre-market on a patent licensing deal with Shanghai Aiko Solar—solar tech could be a contrarian play as energy fears rise. → Stocktwits

- Fitness Brands (Lululemon, Alo): Gen Z's shift to fitness over luxury goods is boosting premium gear—brands like Lululemon are status symbols for a new generation. → Fortune

- Dividend ETFs (SCHD): Schwab US Dividend Equity ETF is a defensive hedge with low tech exposure—ideal for balancing AI-heavy portfolios in this volatility. → Seeking Alpha

|

Sponsored ContentAre You an Accredited Investor? Discover the Accredited Investor Playbook—your guide to exclusive pre-IPO and private placement deals. Know the updated qualifications and where to look in this year's market. By clicking the link you are subscribing to The Investor Newsletter Daily Newsletter and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy. Full disclosures found here. |

🔥 The Big BulletIntel and AMD warn of months-long server CPU delays in China amid AI demandWhat happened: Intel and AMD told some customers in China to expect server CPU deliveries to run late, with delays that could last for months. One report said the bottleneck is tied to unusually strong orders for gear used in AI data centers. In warnings about months-long server CPU delays in China, the companies pointed to tight supply and slow shipment timing. The issue looks focused on higher-end server chips, not basic consumer PCs. That matters because China is a big market for servers sold to cloud firms, internet companies, and large businesses. When server parts arrive late, whole data-center builds can slow down. If buyers cannot get chips on schedule, they may switch orders, delay projects, or renegotiate prices. Investors noticed because chip supply news can move tech stocks quickly.

Why it matters: AI spending is still climbing, and it is putting stress on the supply chain for chips, servers, and power-hungry data centers. Big companies are also trying to use AI to cut costs and speed up back-office work, which can push more demand for new hardware. For example, Goldman Sachs is building AI agents with Anthropic's Claude to automate tasks like trade accounting and client onboarding. When more firms roll out tools like this, they often need more computing capacity, even if the goal is to save labor hours. Shortages or long lead times can raise prices for key parts and squeeze profit margins for hardware buyers. They can also shift revenue timing for chip makers, because sales may move from one quarter to the next. On the market side, supply surprises can widen the gap between "winners" with available inventory and "laggards" that cannot ship. For conservative investors, this is a reminder that fast-growing tech themes can still hit real-world limits like manufacturing and logistics. What's next: Watch for updates from Intel and AMD on when server chip supply will improve and whether the delays spread beyond China. Also keep an eye on any comments from large cloud and data-center builders about project schedules and budgets. Chip demand is closely tied to big spending plans from major tech firms, and those plans can change quickly. Market focus may turn to Nvidia and other AI hardware names, especially after recent stock swings. One trading note said supporters of the bullish case point to big tech spending, and Nvidia's attempt to end a five-day losing streak kept attention on the next wave of AI buildouts. In the near term, earnings calls and guidance could show whether companies are still ordering hardware at the same pace. Any new export rules, shipping limits, or policy changes around China could also affect delivery times. If delays persist, investors should watch for signs of canceled orders versus simple timing shifts. |

| | Reader Feedback | Last time, I asked you: What worries you most about Big Tech's massive AI spending? | The majority of you at 46% said "AI won't pay off anytime soon." | Monica from Alabama replied: "I worry they're spending too much on AI and it might take a long time before it actually makes money." | Here's what I'm asking you today:Which of the following do you think is the bigger risk for tech stocks right now? | |

|

| As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts. |

🧭 Policy & Market Ripples- AI Cybersecurity Risks: OpenAI's GPT-5.3-Codex launch comes with a 'high' risk rating for cyber threats. Restricted API access signals caution for tech investors. → Fortune

- SBA Loan Policy Shift: Starting March 2026, green card holders lose access to SBA loans, cutting $12B in funding. Small business lenders may feel the pinch. → Finance Monthly

- Starbucks Loyalty Backlash: Starbucks' revamped rewards program drops earning rates, sparking customer ire. A 3% revenue dip recovery hinges on merchandise now. → Money

|

📜 This Day in History – February 6 February 6 is infrastructural at its core — new mediums get standardized, new regions enter global markets, and entertainment quietly evolves into an industry built on repeatable formulas. |

| Today's TriviaWhat is a major benefit of having a good credit history? | |

|

| 84% of you chose the right answer to our previous trivia question: What is the main purpose of credit counseling? |

A wise person should have money in their head, but not in their heart.

– Jonathan Swift | Thanks for Reading.

Stay Sharp. Stay Focused.

Fredrick Frost

Editor, MorningBullets |

|

|

|

No comments:

Post a Comment