| |

Trump threatens new tariffs on South Korea Trade tensions return + Why futures are swinging January 27, 2026 |

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored ContentInvest Before the Crowd — Private Market Edge Our latest report reveals how early-stage investing really works — the access, the risks, and the upside. If you've ever wondered how the big players get in before the headlines, this is a must-read. 📊 Download "From Private to Public" By following the link above or using any of the links provided below, you're choosing to opt in to receive insightful updates from Wealth Creation Investing + 2 free bonus subscriptions! Privacy Policy. |

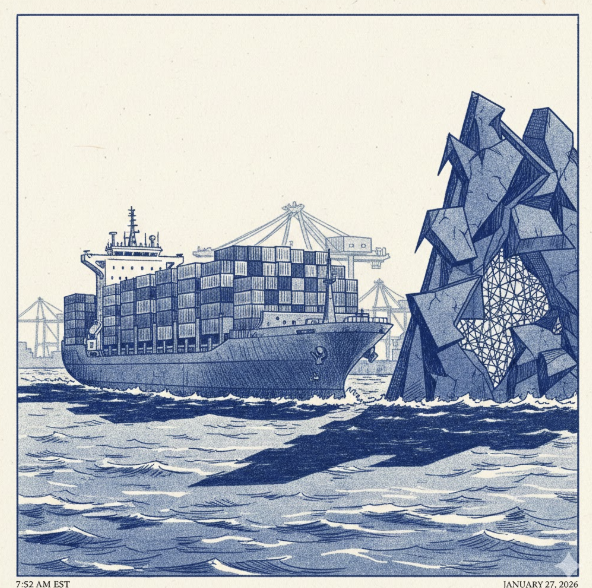

Global supply chains face renewed uncertainty as tariff threats return. Global supply chains face renewed uncertainty as tariff threats return.

Good Morning, U.S. stock futures are swinging between gains and losses this morning after President Trump threatened fresh tariffs on South Korea. We break down why a delayed trade deal is causing friction, what it means for global supply chains, and whether this is a permanent move or just a negotiating tactic. If you are watching international markets, this is the story to read.

Backlash from widespread business leaders over Trump's aggressive Minneapolis immigration enforcement, amplified by the fatal shooting of a U.S. citizen during raids—adds economic and political pressure on Washington, while Trump's $5.5 T "One Big Beautiful Bill" debt plan stirs fiscal risk concerns and investors pivot toward Chinese tech apps as AI strategy shifts

Don't forget to voice your opinion in my polls below.

Here are your Morning Bullets. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapMarkets shook off last week's losses with a fourth straight day of gains on Monday, January 26, 2026. The S&P 500 and Nasdaq led the charge, buoyed by Big Tech strength, while silver posted its best single-day performance since 1985. Beneath the surface, though, volatility lingers with natural gas prices doubling and geopolitical noise keeping investors on edge.

- S&P 500 and Nasdaq Extend Winning Streak: Both indices notched a fourth consecutive session of gains, marking their longest rally of 2026, driven by tech sector resilience. → MarketWatch

- Silver Surges to Historic Levels: Silver recorded its strongest daily gain since 1985, with prices reflecting a broader precious metals rally amid dollar weakness. → Benzinga

- Natural Gas Prices Double in 5 Days: A massive spike driven by Winter Storm Fern has analysts warning of a potential sharp collapse if supply stabilizes. → CNBC

|

📉 Daily Performance Snapshot| Index/Asset | Closing Value | Change |

|---|

| S&P 500 | 6,950.23 | +0.50% | | Nasdaq | 23,601.36 | +0.43% | | Dow Jones | 49,412.40 | +0.64% | | Gold | 5,126.24 | +0.08% | | Crude Oil | 60.52 | -0.18% | | Bitcoin | 87,880.00 | +0.00% | | 10-yr Treasury Yield | 4.228% | +0.33% |

|

🔭 What to Watch TodayToday's calendar is packed with events that could sway markets, from Fed signals to geopolitical trade winds. Keep your eyes on these developments for potential ripples. Fed Meeting Preview (Jan 28): Small and mid-sized firms are glued to the FOMC's guidance as a rate cut pause is expected, with inflation still above target. → TheStreetIndia-EU Trade Deal Fallout: Fresh off a historic free trade agreement, watch for market reactions as this pact counters U.S. tariffs and reshapes global trade. → ABC NewsSalesforce Army Deal: A potential $5.6 billion, 10-year contract with the U.S. Army boosted shares 1.79% premarket, eyeing military tech modernization. → Benzinga News |

💡 Opportunity WatchAmid tech breakthroughs and policy shifts, a few under-the-radar plays are catching my eye. These could offer upside if you're positioned right. - TSMC Expansion (TSM): With a $165 billion push into Arizona driven by land constraints in Taiwan, TSMC is poised to meet soaring chip demand from clients like Nvidia. → Benzinga

- Micron Technology (MU): A $24 billion investment in Singapore for NAND chips signals strong growth potential amid AI data center demand. → Stocktwits

- Silver ETF Plays (SLV): Retail-driven momentum has pushed silver past historic highs, offering a speculative play if volatility holds. → CNBC

|

Sponsored ContentInside Crypto's "Point of No Return" From 600 interviews: the catalyst to watch, the hidden pattern top earners use, and why this cycle could outpace 2017 and 2021. Get Crypto Revolution free—plus bonus guides. 📥 Download Free + BonusesBy clicking the link above you agree to receive periodic updates from our sponsor. |

🔥 The Big BulletPresident Trump Threatens New Tariffs on South KoreaWhat happened: President Donald Trump announced he plans to raise taxes on products coming from South Korea. He stated he is increasing tariffs on South Korean goods because the country's national assembly has not yet approved a trade agreement framework. This delay has caused frustration for the administration. As a result, U.S. stock futures were swinging between gains and losses on Tuesday morning. Markets are reacting to the sudden return of trade tension. Why it matters: Tariffs function like a tax on imports, which can increase costs for American companies and shoppers. When major economies fight over trade rules, it makes investors nervous about future profits. Although Asian shares have mostly gained recently, this news adds a new layer of risk for global markets. Companies that rely on international supply chains often see their stock prices wobble during these disputes. It shows that trade deals remain a volatile part of the current economic landscape. What's next: Traders will watch to see if South Korea's leaders approve the trade framework quickly to avoid the penalty. Some experts suggest these threats should be viewed as prepositioning for better negotiating terms rather than final policy. Meanwhile, the U.S. is making progress elsewhere, as a trade deal between India and the U.S. is reportedly in an advanced stage. Investors should stay alert for official responses from Seoul in the coming days. |

| | Reader Feedback | Last time, I asked you: What do you think gold's big jump is really saying right now? | The majority of you at 47% said "Investors are worried about what's ahead" | Linda from Washington replied: "I think gold is going up because people are nervous and worried about what might happen next." | Here's what I'm asking you today:President Trump is threatening new taxes on South Korean goods to force a trade deal. Do you think this strategy is good for the U.S.? | |

|

| As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts. |

🧭 Policy & Market Ripples- Immigration Enforcement Sparks Business Backlash: Trump's deportation surge in Minneapolis, including a fatal shooting, has over 60 CEOs calling for de-escalation as raids hit retail and factories. → Fortune

- Trump's 'One Big Beautiful Bill' Debt Risk: Projected to add $5.5T to the deficit over a decade, the bill challenges growth-driven debt reduction strategies. → Fortune

- China's AI Shift to Applications: Investors pivot from hardware to consumer AI apps, with Alibaba and Tencent poised to lead in generative engine optimization. → CNBC

|

📜 This Day in History – January 27 January 27 has a utility-grid sensibility: standards get written, creativity gets industrialized, and the "everyday" quietly becomes an engineered product. If you like your progress measurable, today delivers. |

| Today's TriviaWhat does the term household debt refer to? | |

|

| 87% of you chose the right answer to our previous trivia question: It allows living standards to improve over time |

You can be young without money, but you can't be old without it.

– Tennessee Williams | Thanks for Reading.

Stay Sharp. Stay Focused.

Fredrick Frost

Editor, MorningBullets |

|

|

|

No comments:

Post a Comment